|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

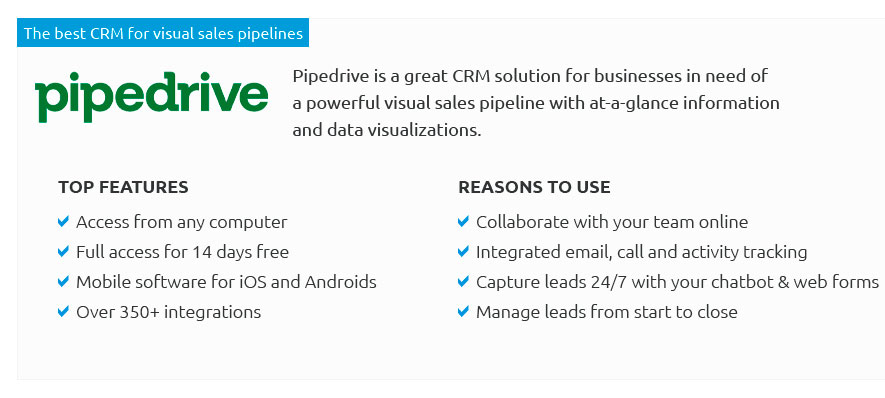

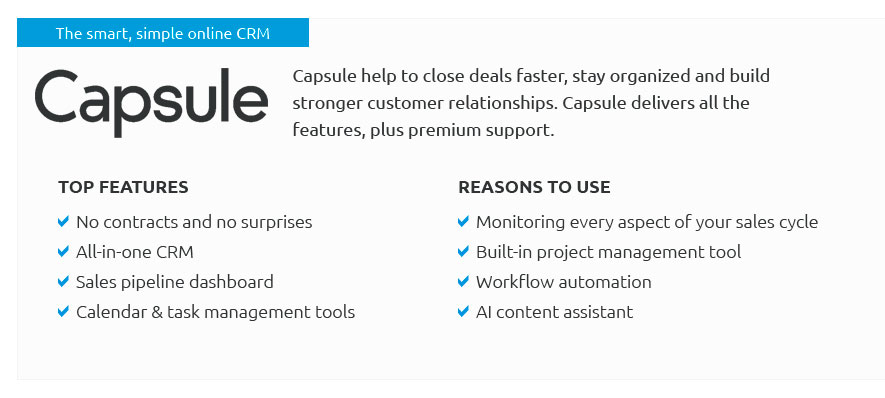

CRM for Insurance Agents: Navigating the Digital LandscapeIn the intricate world of insurance, where the stakes are high and the details are critical, Customer Relationship Management (CRM) systems have become indispensable tools for agents striving to enhance their customer interactions and streamline operations. As the insurance industry evolves, integrating a robust CRM is not just a trend but a necessity, particularly in a field where personal relationships are paramount. However, the journey to effectively implementing a CRM system is fraught with potential pitfalls that can thwart even the most tech-savvy insurance professionals. Understanding the Essentials of CRM At its core, a CRM system is designed to manage a company's interactions with current and potential customers. For insurance agents, this translates into a centralized hub where all client information, policy details, and communication history are meticulously organized. The ability to access comprehensive data at a glance can dramatically improve the efficiency and effectiveness of an agent's workflow. Yet, the real value of CRM lies not just in the accumulation of data but in the actionable insights it provides, enabling agents to anticipate client needs and tailor their services accordingly. Common Mistakes to Avoid While the advantages of CRM systems are clear, many insurance agents stumble in their implementation due to a few common missteps. Here, we delve into these pitfalls and how they can be sidestepped to ensure a seamless integration process.

The Future of CRM in Insurance Looking ahead, the role of CRM systems in the insurance industry is poised to expand even further, with innovations like artificial intelligence and predictive analytics becoming integral components. These advancements promise to further refine how agents manage relationships and anticipate client needs. The insurance agents who embrace these technologies, while avoiding common pitfalls, will be well-positioned to thrive in an increasingly competitive marketplace. Ultimately, the successful implementation of a CRM system hinges on an agent's willingness to adapt and embrace change, fostering a culture that prioritizes continuous learning and improvement. By doing so, insurance agents not only enhance their operational efficiency but also build stronger, more lasting relationships with their clients, securing their position as trusted advisors in the ever-evolving landscape of insurance. https://www.ezlynx.com/blog/posts/insurance-crm-vs-insurance-agency-management-system-whats-the-difference/

An insurance CRM system is software used to manage, track and organize an insurance agency's customer relationships. https://www.agencybloc.com/

AgencyBloc's Plus Suite of industry-specific solutions helps health, senior, and benefits agencies organize ... https://www.salesmate.io/blog/crm-for-insurance/

CRM software helps insurance agents and brokers in sales by providing them with an organized view of customer data.

|